We reached out to our Wavebid users and asked them about their more technical questions. For the next several weeks, we’ll be reviewing the responses we sharing our solutions and thoughts.

If you have a question for us, you can submit yours here!

Doug Macon of Macon Brothers Auctioneers asked us a great question about sales tax calculations in Wavebid.

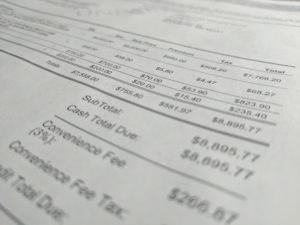

Doug noticed that the sales tax collected by Wavebid can show up as a little bit less than if the tax were applied to the auction gross. He speculated that the discrepancy might be caused by the way Wavebid applies tax to dollar amounts, and indeed, Doug is correct. Wavebid calculates tax on the individual lots, rather than on the auction gross.

There are a couple of things to keep in mind here. First let’s talk about the procedure behind the scenes. The discrepancy  between Wavebid’s calculation and a back-of-the-envelope calculation done at the end of a sale cannot and will not exceed one cent per lot. On an invoice, each item’s tax is calculated independently and rounding will occur for each item, either up or down to the nearest cent. For an invoice with a single item, the end result will be ∓1¢, however invoices with multiple items will create a null difference and will inevitably vary towards an absolute reckoning as one item might be rounded down and the next rounded up. That said, at the end of the day, we’re talking about a fraction of a fraction of a difference, perhaps a penny per thousand dollars.

between Wavebid’s calculation and a back-of-the-envelope calculation done at the end of a sale cannot and will not exceed one cent per lot. On an invoice, each item’s tax is calculated independently and rounding will occur for each item, either up or down to the nearest cent. For an invoice with a single item, the end result will be ∓1¢, however invoices with multiple items will create a null difference and will inevitably vary towards an absolute reckoning as one item might be rounded down and the next rounded up. That said, at the end of the day, we’re talking about a fraction of a fraction of a difference, perhaps a penny per thousand dollars.

Secondly we should discuss the philosophy behind the scenes. Every time an auctioneer calls “SOLD” on an item, he or she creates a verbal contract with the buyer — a contract that is sacrosanct in the industry. It should be noted, however, that a contract is made at the sale of each item and not as the bidder is checking out. In the strictest sense, the auctioneer is selling each item individually, at which point, again in the strictest sense, tax is charged to each item. An invoice is simply a list of the contracts made between auctioneer and buyer, collected, itemized, and displayed on a single page to make the lives of all involved a little bit easier. The long and short of it is that Wavebid applies tax to items, rather than to the sale as a whole.

Thanks for reading, and I hope this clarifies things, Doug! Tune in next Monday when we’ll delve into advanced techniques for utilizing seller settlements.