Many auctioneers have come to realize the recent Supreme Court decision on South Dakota v Wayfair has created an incredible burden related to tax collection when selling to buyers located in a different state from the auction. The Court has ruled that states are allowed to collect tax from online retailers (auctioneers) even if companies do not have a physical presence in the state.

Wavebid is committed to providing solutions to minimize the impact for our clients. The Supreme Court said in its ruling that states cannot create undue burdens to interstate commerce. So far guidance from states suggests that there will be required minimum monetary and total transaction amounts before a retailer has to collect taxes.

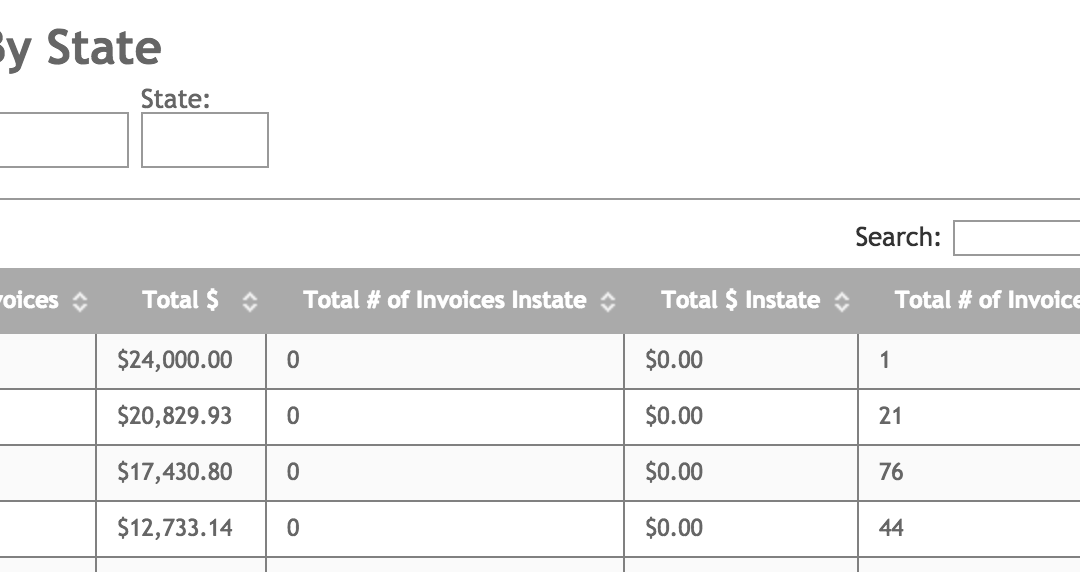

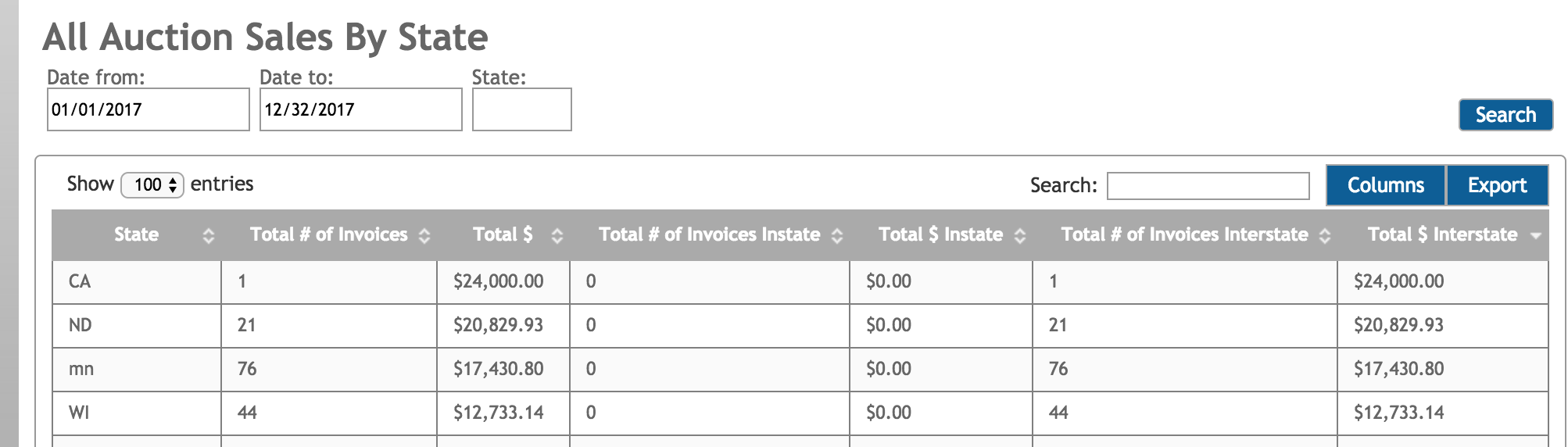

We have recently deployed a report that allows our users to look back at a given time period to see how many transactions occurred and what amount was spent by buyers in a particular state. This information can be used in determining which states an auctioneer will have to register and collect tax. While no one can predict future sales, past sales can be a good indicator of future activity.

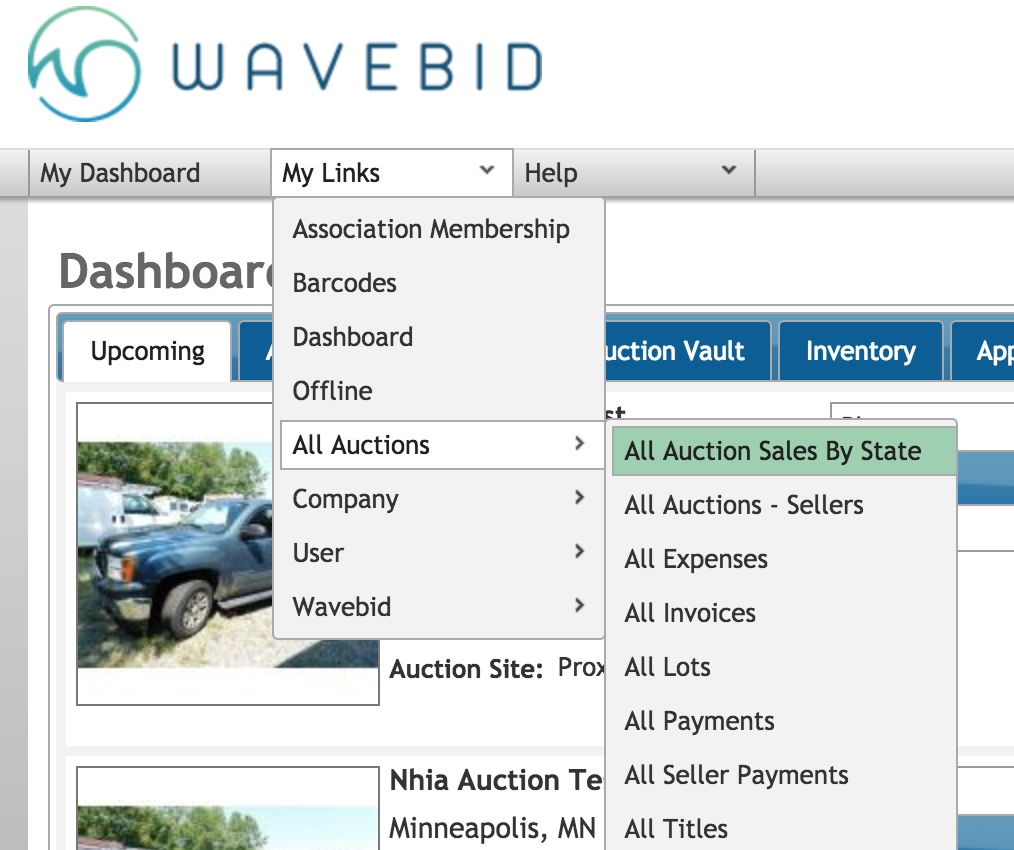

To access the report in Wavebid go to My Links -> All Auctions -> All Auction Sales by State. You can select the date range and search all states or select specific states. This report will display total transactions by state as well as the total collected from those transactions.

We will continue to evaluate the best way to make future improvements to our robust tax tracking system to make this reality as easy as possible for our customers.